Piano Guidance

Piano Guidance

Piano Guidance

Piano Guidance

Photo: Victoria Akvarel

Photo: Victoria Akvarel

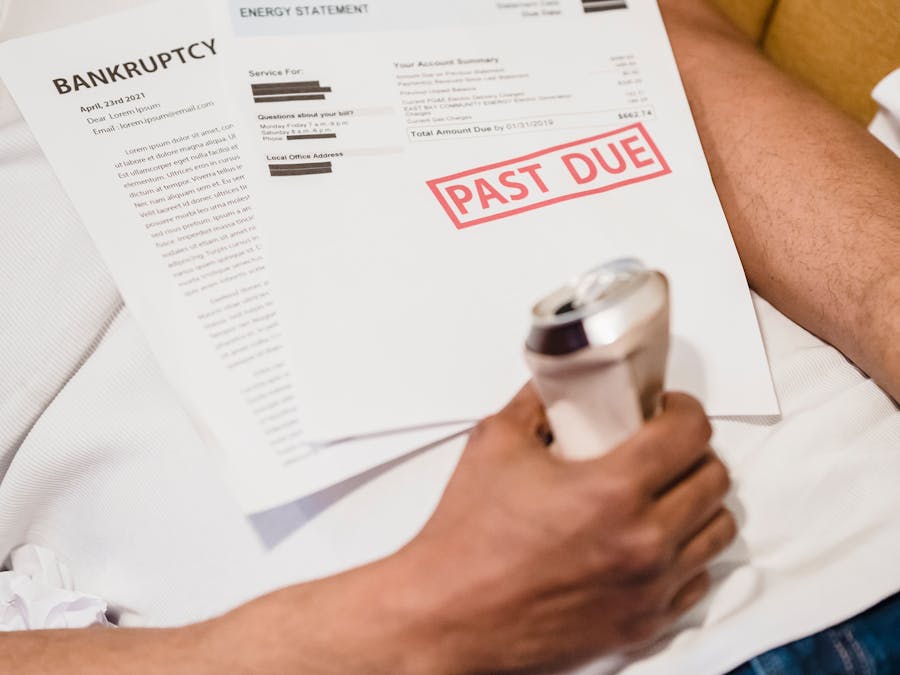

They Set and Achieve Goals Wealthy people don't simply expect to make more money; they plan and work toward their financial goals. They have a clear vision of what they want and take the necessary steps to get there.

As you move north, species like maple (red and sugar), white ash, and basswood become more preferred species where they are more abundant. While...

Read More »

Lastly, you can play a number of multi-chords in the piano – a feat not available on a guitar. To summarize the answer, yes, piano chords and...

Read More »If you haven’t read the book "The Millionaire Next Door: The Surprising Secrets of America's Wealthy," by Thomas J. Stanley, Ph.D., and William D. Danko, Ph.D., you must put it on your reading list. The best-selling book identifies several common traits that show up many times over among those who have accumulated wealth. If the word "wealth" conjures up images of mansions and yachts, think again. The "millionaires next door" are people who don’t look the part. They are the people standing behind you in the grocery store line or pumping gas next to you into their not-so-fancy car. Note You also might want to read the follow-up book, "The Next Millionaire Next Door: Enduring Strategies for Building Wealth," by Thomas J. Stanley, Ph.D., and Sarah Stanley Fallaw, Ph.D. For the most part, the millionaires next door are underconsumers. They spend far less on material things than their peers. And they have achieved their status because they have consistently employed several wealth-building strategies that any of us can use—beginning today. Here are twelve things the millionaires next door do to gain their wealth.

Becoming a concert pianist requires true dedication, talent, and hard work. On average, it will require 15+ years, 3-5 hours a day of deliberate...

Read More »

No matter when you begin piano, you can have the enjoyment of playing an instrument, plus all the great mental, physical, and emotional benefits....

Read More »These people guard their FICO scores closely so they can keep lower interest rates on major purchases, such as mortgages and car loans. They also do this by limiting their debt. Considering the prime importance of income, wealthy retirees go a step further to secure at least three income sources. Those sources tend to come from a combination of Social Security, pension, part-time work, rental income, other government benefits, and, most important, investment income.

Best Female Chefs in the U.S. Dominique Crenn. San Francisco, CA. ... Renee Erickson. Seattle, WA. ... Suzanne Goin. West Hollywood, CA. ......

Read More »

If you search for lists of the best jazz piano players, you'll almost always find Herbie Hancock. His innovative playing cuts across styles from...

Read More »

Sergei Rachmaninov Sergei Rachmaninov, the famous Russian composer, pianist, and composer, was born in 1873 into a family that descended from the...

Read More »