Piano Guidance

Piano Guidance

Piano Guidance

Piano Guidance

Photo: Polina Kovaleva

Photo: Polina Kovaleva

Here's how you can become a millionaire in five years or less. Select your Niche. ... Put aside 20% of your income every month. ... Don't spend anything other than essentials. ... Get out of debt as quickly as possible. ... Start building Passive Income Streams.

Mozart, the legendary Austrian composer, is believed to have the highest IQ ever. Jul 28, 2022

Read More »

There's evidence that the brain's ability to make subtle distinctions between different chords, rhythms and melodies gets worse with age. So to...

Read More »

As a general rule, the fourth is always two guitar frets above the minor third. Note that the sus4 chord is neither major nor minor (this is why we...

Read More »

After six months, you should start to feel comfortable and know your way around a guitar. You might not be busting out amazing solos quite yet, but...

Read More »

It has no intrinsic value, but its cultural uses make ivory highly prized. In Africa, it has been a status symbol for millennia because it comes...

Read More »

Für Elise Key A minor Catalogue WoO 59 Bia 515 Composed 27 April 1810 Published 1867 3 more rows

Read More »

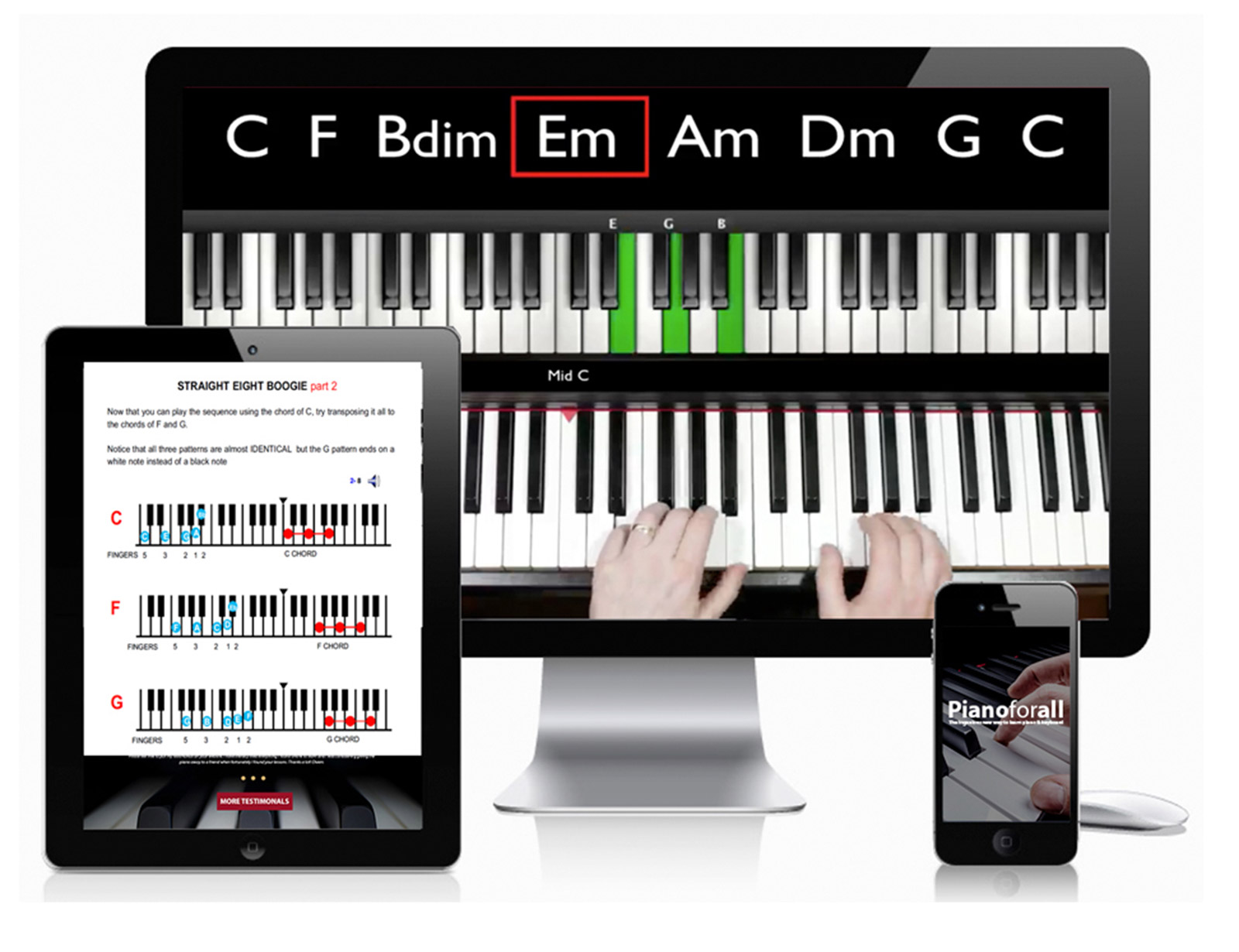

Pianoforall is one of the most popular online piano courses online and has helped over 450,000 students around the world achieve their dream of playing beautiful piano for over a decade.

Learn More »

But there's more. Because the sound of a piano starts inside the instrument with all of those strings and mechanical parts, you'll get a louder,...

Read More »

every thirty years How Often Should A Piano Be Restrung? A general rule of thumb is that all of the strings in a piano should be replaced every...

Read More »